One in five cars now come with a plug, but chargepoint rollout is failing to keep pace

New car market records for January from the Society of Motor Manufacturers and Traders (SMMT) show that sales of hybrid and electric vehicles rose, but electric vehicle chargepoint rollout is failing to keep pace with the increasing demand.

SMMT’s data shows hybrid electric vehicles (HEVs) comprised 14.4% of new car registrations, increasing volumes by 40.6%. Meanwhile, battery electric vehicle (BEV) registrations rose 19.8% to reach 17,294 units, or 13.1% of new registrations – which as a percentage is slightly below the average recorded for 2022. Plug-in hybrid vehicles (PHEVs) recorded a 0.7% rise in units sold, but their share fell to 6.9% of new cars on the road. Overall, says SMMT, one in five new cars registered in the month “came with a plug”.

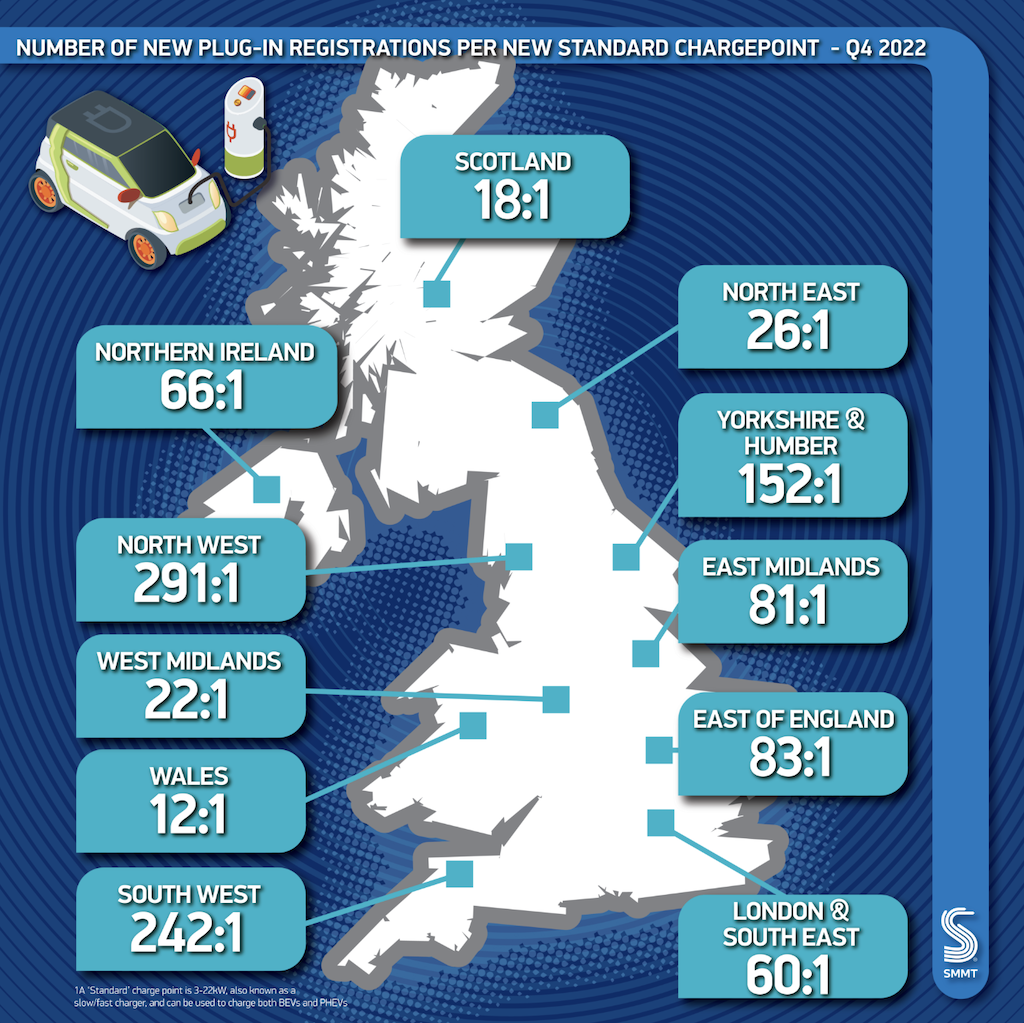

However, points out SMMT, during Q4 2022, the ratio of new chargepoint installations to new plug-in car registrations dropped to one for every 62 – a significant fall compared with the same quarter the previous year, when the ratio was one in 42.

In 2022, says SMMT, one standard public charger was installed for every 53 new plug-in cars registered, which is the weakest ratio since 2020.

SMMT says mandating rollout targets for infrastructure and regulating service standards would give drivers certainty they can always find a working, available charger and that “infrastructure must be built ahead of demand else poor provision risks delaying the electric transition.”

SMMT also echoed the commonly held industry view that the upcoming Budget is an opportunity to implement measures that support the electric vehicle transition. Specifically it has joined the growing number of industry voices, from the RAC to Faircharge, calling for VAT on public chargepoint use to be reduced from 20% to 5% in line with home charging.

Government, it says, should also review proposals “to graft a Vehicle Excise Duty regime designed for fossil fuel cars onto zero emission vehicles (ZEVs)”. The higher production costs associated with electric vehicles means that currently more than half of all available BEVs would be subject to the expensive car supplement due to apply to ZEVs from 2025.

“While it is right that all drivers pay their fair share, existing plans would unfairly penalise those making the switch, and risk disincentivising the market at the time when EV uptake should be encouraged. Government should also tackle other fiscal blocks to uptake by raising recommended business mileage rates,” SMMT said in a statement.